Objectives

“Ensuring a resilient and thriving Real Estate sector under new climatic conditions”

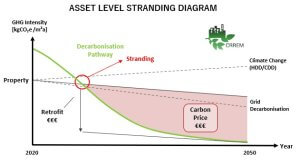

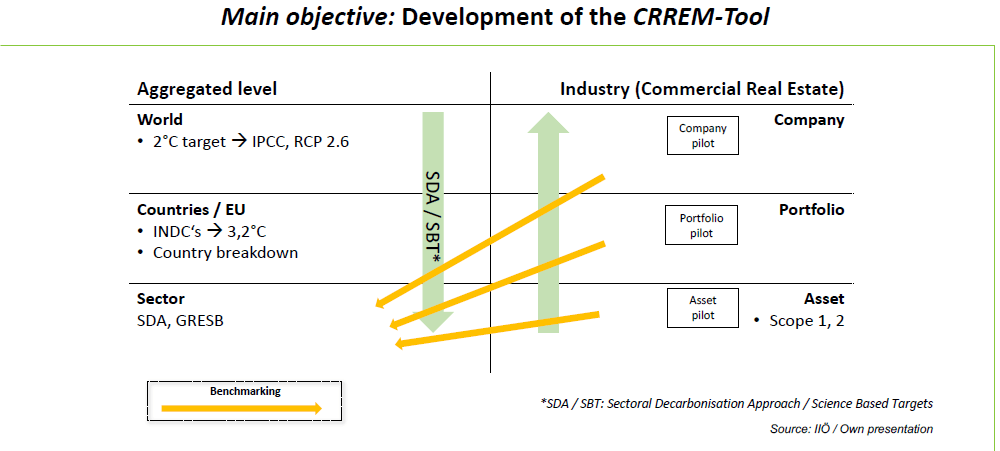

CRREM will accelerate the decarbonization and climate change resilience of the EU commercial real estate sector by clearly communicating the downside financial risks associated with poor energy performance and the quantification of financial implications of climate change on the building stock. Therefore, CRREM will provide the industry with appropriate science-based carbon reduction pathways at building, portfolio and company level and with financial risk assessment tools to cost-effectively manage carbon mitigation strategies. The project aims at optimizing industry’s investments in energy efficient retrofits by making risks more transparent and by unveiling opportunities for property owners and investors. CRREM will provide the industry with a tool to assess ‘stranding’ risks, applicable GHG-reduction pathways according to the Science-Based Targets Initiative, and reporting templates, which will contribute to accelerating the decarbonization of the EU building stock to “2-degree-readiness”.

“Providing the tools to identify the buildings most at risk and prepare them for adaptation”

The downscaling of EU’s carbon reduction commitments to the Paris Agreement to the sector and building level will contribute to the reduction of carbon emission and an increase of investment in sustainable retrofits. Users of the CRREM tool will be able to monitor the energy performance of single properties as well as of portfolios and whole companies, benchmark their performance and assess their ‘stranding risk’ due to regulatory changes, potential shifts in energy costs and refurbishment measures. The CRREM toolkit will further allow for a straightforward graphical assessment of ‘stranding risks’ of single properties and whole portfolios (see figures).

The stranding diagram is also available in Japanese!

(Source/Translation: CSR Design / Ministry of Land, Infrastructure, Transport and Tourism)

The overall objective of the Carbon Risk Real Estate Monitor Project (in short CRREM) is to contribute to an increase of energy efficiency investments in the real estate sector by addressing the need to understand the down-side-risk of climate change. Hence, we focus on decarbonisation requirements of the assets under management compared to the overall sector targets and INDCs.

Additionally, CRREM seeks to accelerate the decarbonisation of the real estate sector by enabling investors to set science-based carbon targets and reduction pathways and with monitoring tools that are necessary to manage efficiency measures effectively. CRREM addresses the following sub-objectives in order to fulfil the overall goal:

- Objective 1 – Downscaling & transparency: Breaking down INDCs by sector, company and property level for more transparency and capacity building

- Objective 2 – Strategic implication of “Stranded assets”: [1]Defining areas for improvement and strategic options

- Objective 3 – Framework, Toolkits & Methods: Making decarbonisation in the commercial real estate sector measurable

[1]“Stranded assets“ are properties that will not meet future energy efficiency standards and market expectations and might be increasingly exposed to the risk of early economic obsolescence.

The benefits of using CRREM ressources

CRREM is the leading global standard and initiative for operational decarbonization (of real estate assets. Major investors with over 450 Bn. Euro AuM have already applied CRREM on a regular basis in order to avoid stranding risk, address transition risk and comply with Paris-aligned decarbonization efforts. The tool has already been used for over 3,300 properties, representing more than 23 Mill. m² space globally (date: 01.07.2021).

CRREM resources have undergone intensive quality assurance and international consultation. Stakeholders applying tool and pathways have therefore a reliable and proven methodological approach to address transition risk.

CRREM initiative is collaborating and aligning with organisations and initiative addressing transition risk worldwide.

We encourage investors, financial institutions, corporates and asset managers to join the initiative and commit to assess and disclose their GHG emissions associated with their real estate portfolio according to the CRREM pathways. CRREM is open to any interested stakeholders and aims at further growing the number of commitments to the pathways. CRREM resources can support stakeholders in many ways:

- Learn more about your (real estate related) carbon and overall GHG emissions,

- Enable development of strategies regarding mitigation,

- Enable investors to align their real estate portfolios against Paris-compliant-decarbonization-pathways (including 1.5°C and 2C° scenarios),

- Undertake aggregated analysis of portfolios,

- Track mitigation of GHG over time each year and evaluate the progress of investors’ carbon performance,

- Monetarization of transition risk for operational carbon emissions / Quantify risk on property and portfolio level,

- Support transparency and communication regarding ESG targets,

- Analyse impact of retrofit on total carbon performance (trade-off of embodied carbon vs. operational savings),

- Visualize the energy performance of single properties, portfolios and companies,

- Use massive amount of default data (on EF, Carbon Pricing, Development of energy mix, HDD/CDD etc.) or own assumptions,

- Apply proven and reliable methodology based on SBti SDA convergence approach,

- Create transparency and accountability, and to enable real estate investors to align their portfolio with the Paris Climate Agreement,

- Ensure alignment with many other standards and initiatives (GRESB, INREV, PCAF, etc.).

CRREM supports stakeholder in clearly communicating the downside financial risks associated with poor energy and carbon performance and quantifying the financial implications of climate change on assets.